ARTICLES

As market leaders in our field, we are in a unique position to provide commentary and articles of interest in the markets we research.

November 1, 2019

Sentiment remains bearish… half the institutional investors and other senior executives interviewed in the third quarter of 2019 expect the economy to weaken furhter into the […]

April 5, 2019

Over 500 senior corporate executives and asset owners expect the economy to weaken further, the Peter Lee Associates’ Net Confidence Index is at the lowest […]

August 22, 2018

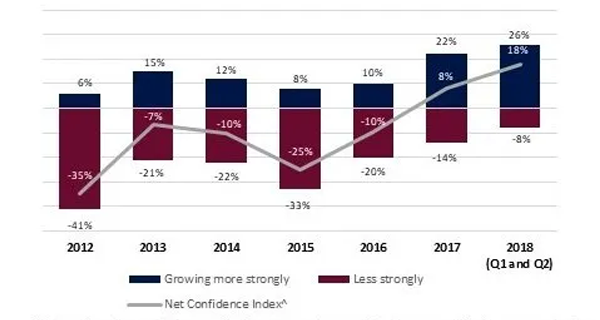

Interviews with almost 600 senior corporate executives and asset owners (H1 2018) reveals business confidence remains strong – but the overall result masks a decline in […]

July 11, 2018

Non-bank market makers in Australian FX are not taking away many big clients from banks, but they are taking meaningful market share in smaller clients. One […]

October 20, 2017

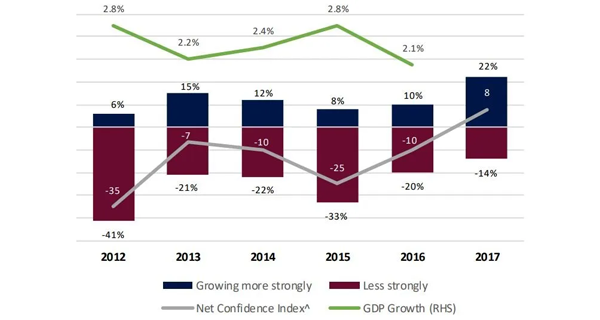

^ Proportion of respondents expecting the economy to grow minus those expecting the economy to slow. * Confidence Index data collected as of 20 October 2017. […]

May 23, 2017

At approximately the same time each year Peter Lee Associates undertakes its Debt Securities Investors and Australian Equity Investors research programs. Despite these clearly focusing on […]

April 21, 2017

Net Confidence Index vs. GDP Growth Proportion of respondents expecting the economy to grow minus those expecting the economy to slow. Based on over 1300 interviews […]

April 21, 2017

It is a little more than 10 years since the Principles of Responsible Investment organisation was established with a Mission Statement reading – “We believe that […]

March 17, 2017

Having conducted Peter Lee Associates research programs for more than 25 years, we have access to much historical data and commentary which enables us to observe […]

February 19, 2017

With most senior executives receiving a large part of their annual remuneration in the form of long term share based incentive schemes, it would seem only […]

February 19, 2017

Each year Peter Lee Associates speaks to Institutional Equity market participants in order to better understand how they view the service provided by their preferred stockbrokers. […]

January 31, 2017

In 2016 the real estate industry found itself in the sweet spot – low and falling interest rates, a relatively weak Australian dollar, a lack of […]

January 5, 2017

Here at Peter Lee Associates we conduct research programs that focus on various asset classes — Equities, Fixed Income, Property, and Currencies — and across different […]

January 2, 2017

We wrote recently that institutions are no longer paying as much for broker research. But, as the 2016 Peter Lee Australian Equity investors research shows, as […]

December 13, 2016

As we begin the rundown to Christmas and 2017 it’s perhaps appropriate to reflect on the past 12 months. A year which, in global terms, saw […]

November 30, 2016

It used to be that to do Institutional stockbroking well it was imperative you had a quality research product, good salespeople and a team of top […]

November 14, 2016

One of the areas Peter Lee Associates explores as part of our Real Estate Services research program, is the basis on which investors award a mandate […]

October 27, 2016

At Peter Lee Associates we have been conducting research programs for almost 30 years. Over that period we have witnessed first hand the impact of internationalisation […]

October 17, 2016

One of the findings from this year’s Peter Lee Associates Corporate Advisory research program is how few of the leading Investment Banks seem to understand the […]

October 10, 2016

A finding from this year’s Peter Lee Associates Corporate Advisory research program is that, whilst idea generation and working hard at being proactive on behalf of […]